By Jennifer McChriston Senior Energy & Security Correspondent

When oil flows, economies grow. When oil is disrupted, global stability hangs in the balance. As global chokepoints come under increasing stress, conflicts escalate in West Asia, and Africa reassesses its resource strategy, the post-Cold War world order faces a historic realignment.

This strategic brief explores how maritime vulnerabilities, shifting alliances, and Africa’s underleveraged energy capacity are reshaping global power dynamics—and why this could mark a turning point for African sovereignty and development.

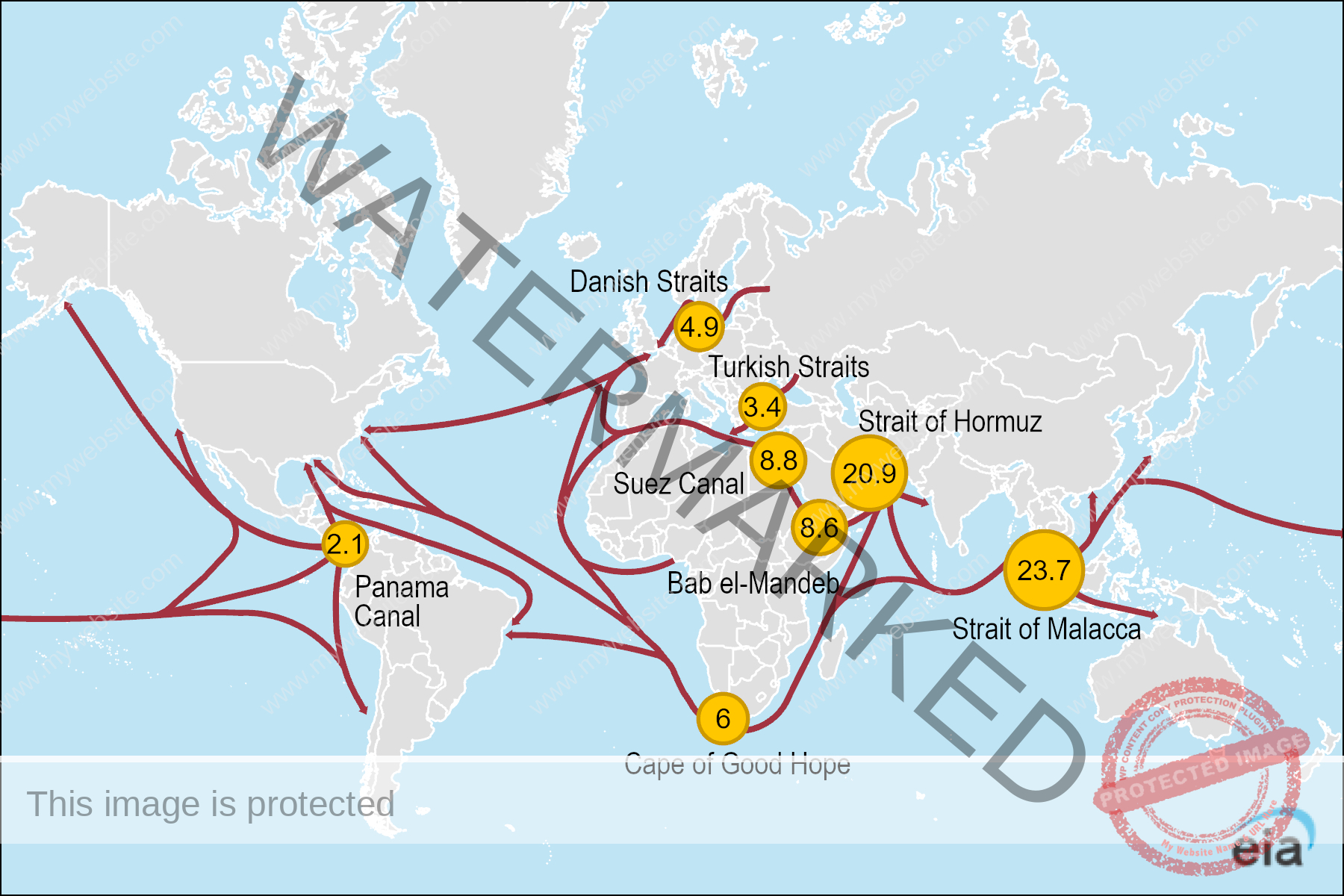

Global Oil Chokepoints: Strategic Arteries Under Pressure

Approximately 60% of globally traded oil moves through just seven critical maritime chokepoints—vital corridors whose disruption can trigger financial and geopolitical tremors.

Chokepoint Daily Oil Flow Current Risk Factors

Strait of Hormuz 17M barrels Regional conflict, increased military presence.

Bab el-Mandeb 6.5M barrels Pirate activity, regional instability.

Suez Canal 5M barrels Political tensions, trade congestion.

Strait of Malacca 15.7M barrels Great power naval competition (U.S.-China-India).

Turkish Straits ~3M barrels Black Sea tensions involving NATO and Russia.

Panama Canal <1M barrels Drought, capacity limits

Cape of Good Hope Emergency bypass Growing piracy risk, shifting shipping routes

Disruptions in any of these lanes affect supply chains, energy prices, and national security frameworks globally.

The Iran-Israel Conflict: Impacts on Energy and Security

Recent tensions between Iran and Israel have intensified regional uncertainty, particularly around the Strait of Hormuz and the Red Sea. While immediate triggers remain disputed, the broader context includes concerns over nuclear programs, regional influence, and energy infrastructure.

Energy analysts warn that continued escalation could affect:

– Oil insurance premiums in the Gulf region.

– Shipping lane security, especially for tankers navigating the Persian Gulf.

– Strategic realignments, involving major powers like the U.S., China, and Russia

While motives are complex, the outcome—increased volatility and risk to oil flows—is clear.

The Shifting Role of the United States in Global Energy Politics.

Several geopolitical observers note that the United States’ traditional dominance in securing global energy flows is being tested due to:

Economic Pressures.

Rising national debt.

Growing de-dollarisation initiatives (e.g., BRICS+ trade in local currencies)

Military Distribution.

Strained deployments across Asia, the Middle East, and Europe.

Maritime security gaps in regions like the Gulf of Guinea and Red Sea.

Domestic Polarisation.

Policy uncertainty and internal divides influencing foreign engagements

This dynamic is leading to a multipolar energy order—with emerging powers and regional blocs shaping trade and security frameworks in more diverse and decentralized ways.

Africa’s Energy Potential: From Resource Base to Policy Leadership.

Africa holds over 125 billion barrels of proven oil reserves, yet continues to export 90% of its crude unrefined. As the global energy landscape changes, African oil-producing nations have a rare opportunity to reposition themselves—from suppliers to strategic partners in global energy governance.

Challenges

Limited refining capacity.

Foreign-dominated extraction contracts.

Infrastructure and policy gaps.

Opportunities

Regional cooperation for refining and pipeline infrastructure.

Local content policies to increase domestic value capture.

Strategic participation in emerging trade blocs and currency frameworks.

For a Strategic Roadmap for African Energy Sovereignty, based on industry consultation and regional expert input, The Independentist news proposes the following five-pillar strategy:

1. Build Refining and Storage Infrastructure, by Investing in modular and regional refineries and Creating sovereign oil reserves for crisis resilience

2. Diversify Trade and Currency Options. Pilot local and BRICS+ currency oil contracts, and reduce exclusive dependence on U.S. dollar systems

3. Enhance Maritime Security, by Supporting AU-led naval patrols in the Gulf of Guinea and Indian Ocean and Investing in anti-piracy and surveillance capabilities

4. Use Oil to Fund the Green Transition, by Channelling oil revenues into solar, wind, and hydro projects and promote Africa as a renewable energy manufacturing and innovation hub.

5. Engage Multipolar Partnerships and Leverage oil in diplomacy with China, EU, Gulf states, and BRICS, avoiding overdependence on any single external partner

Conclusion:

Now is a defining Moment for Africa in a Changing World. From Hormuz to the Gulf of Guinea, the current era is not defined by dominance—but by strategic rebalancing. As traditional powers reassess their global roles, Africa must act not as a passive recipient of energy demand, but as an architect of new trade, security, and innovation alliances.

The continent’s energy future can either be determined by external contracts—or shaped by homegrown strategies that promote economic sovereignty and environmental sustainability.

The next chapter will not be written in Washington or Beijing—but in Abuja, Luanda, Maputo, and Accra—if Africa rises to the occasion.

Jennifer McChriston is Senior Energy & Security Correspondent for The Independentist, covering global oil politics, maritime chokepoints, and African energy diplomacy.

Leave feedback about this